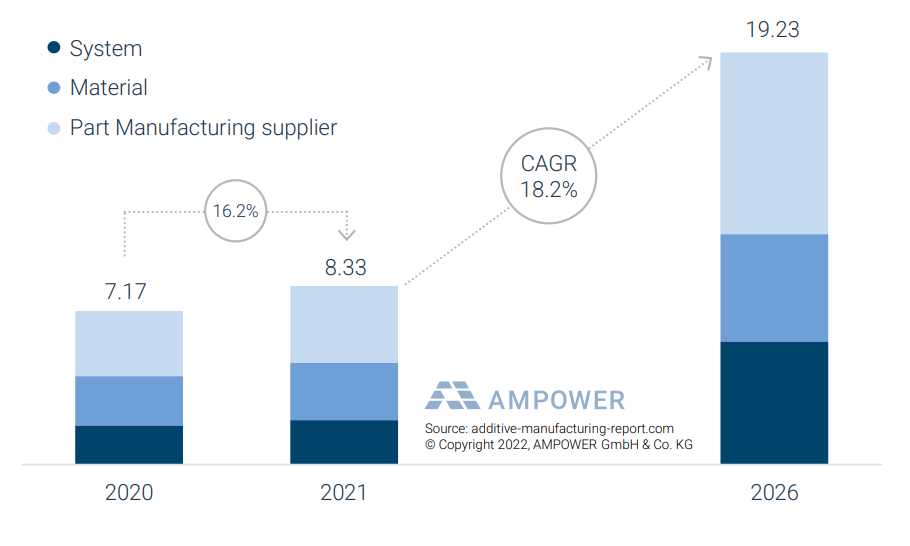

Industrial 3D printing consultancy specialist AMPOWER has projected the additive manufacturing market will experience a yearly growth of 18.2 percent over the next four years.

In the firm’s latest market research, it found that 2021 was marked by regained growth after the initial impact of the Covid-19 pandemic, and as such by 2026 the overall 3D printing sector will be worth an estimated €20 billion by 2026.

The report also values the polymer 3D printing market at two and a half times the size of metal, although the latter is tipped to grow at a rate of more than 25 percent until 2026 compared to just 14.4 percent for polymers.

PBF leading the way for Metal AM

AMPOWER’s survey is targeted towards machine suppliers, with system supplier respondents reportedly representing more than 90 percent of the worldwide installed base of metal and polymer 3D printing systems. The firm claims to have amassed more than 23,600 data points for its latest report, providing a comprehensive mixed market dataset designed to predict future developments.

The firm’s previous market research report predicted the market’s rapid recovery from the Covid-19 pandemic would see metal 3D printing grow significantly over the next few years, and this year at least this estimation seems to be ringing true.

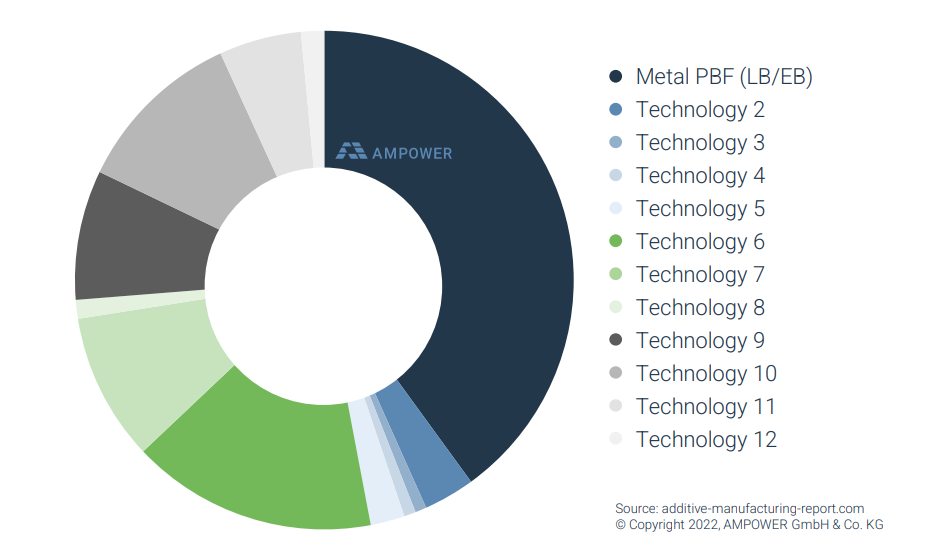

AMPOWER’s latest survey has valued the metal additive manufacturing market at €2.5 billion in 2021, with an expected yearly growth of 25.5 percent until 2026. Powder bed fusion (PBF) technologies continue to dominate the market, taking the largest share of the sector’s systems sales at 40 percent.

The report states that, generally, sinter-based technologies are continuing to attract much attention, although many in the industry have recognized that despite the potential of these highly productive methods, it may take longer than initially thought to transition these technologies into production settings. In this vein, the report underlines the importance of development efforts regarding part design, process simulation, and post-processing to enable such technologies to achieve industrialization.

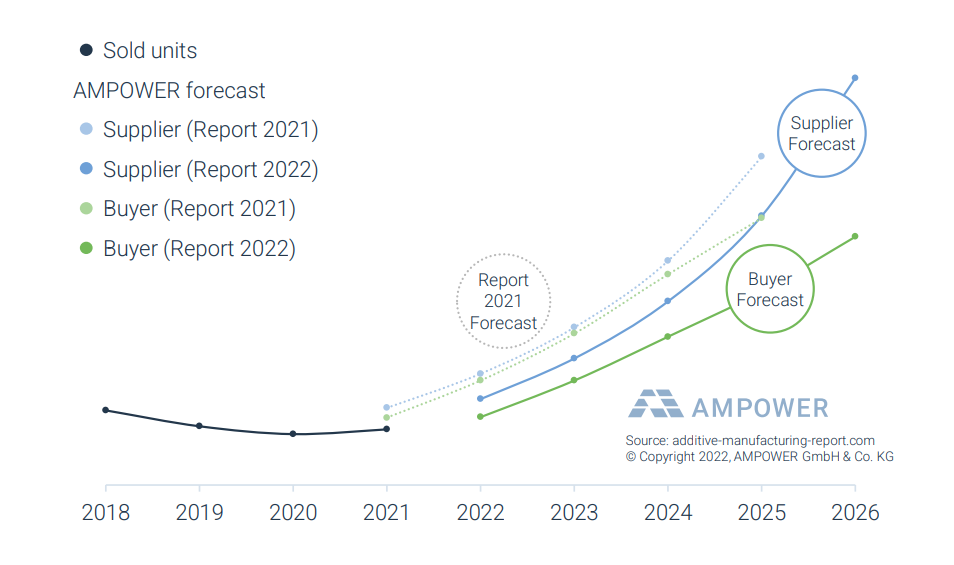

Interestingly, the report found a large discrepancy between the expectations of suppliers and buyers who contributed their insights, particularly regarding metal material extrusion. While suppliers of metal extrusion-based systems predict they will have a market share of 20 percent of sold systems in 2026, buyers were less optimistic, projecting a share of below three percent.

The report suggests similar effects can be seen, albeit on a less severe scale, when looking at the sales numbers of PBF systems. According to AMPOWER, sales of PBF systems have not progressed as expected and still remain below the record year for units sold in 2018.

1,533 PBF systems were sold in 2021, slightly below the 1,645 systems forecast by buyers in past years, and significantly less than the 1,739 sold units predicted by suppliers. The report states that comparing the suppliers and buyers outlook from last year’s survey to this year’s, both groups have curbed their expectations going forwards.

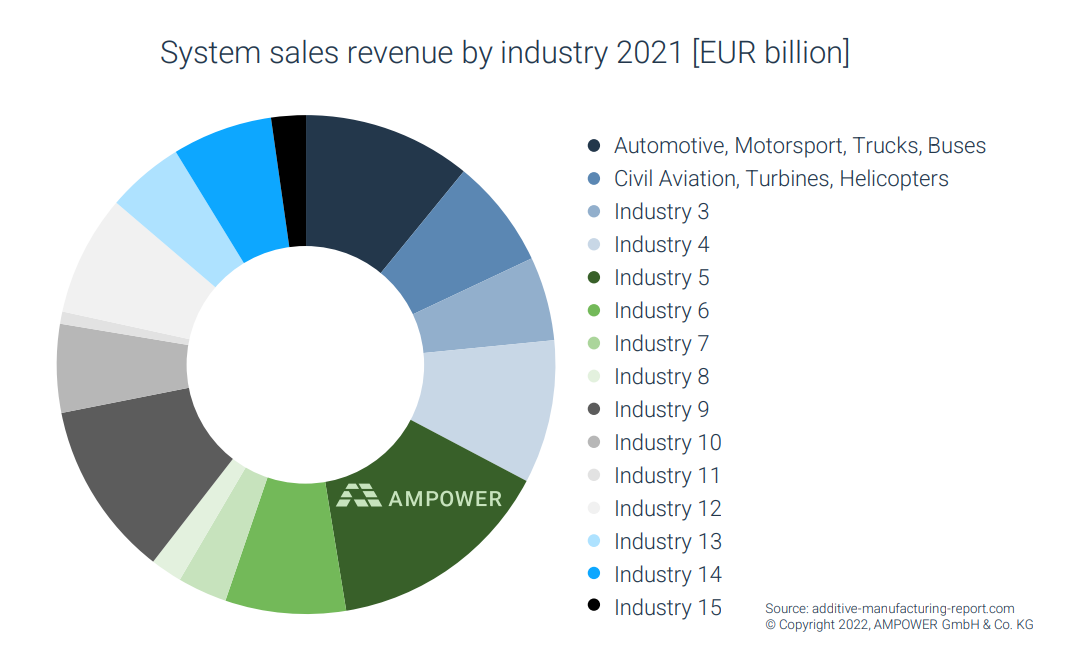

Medical leads machine sales revenues

According to AMPOWER’s report, the medical sector remains the strongest overall segment in additive manufacturing, purchasing machines with a value of €302 million in 2020. The sector’s share of total system sales revenue decreased to 15 percent in 2021 from 19 percent in 2020, however, after a rise in 3D printing systems were acquired during the pandemic to overcome healthcare supply chain issues.

The report highlights an initial lack of nasal swabs, such as those produced by MIT spin-out OPT Industries, as one example that led to a hike in 3D printing systems sales before conventional supply chains caught up with demand and the need for printing them stopped.

According to AMPOWER, space currently dominates metal system revenues in terms of high-ticket sales of larger machines. Regarding polymers, the automotive, medical and industrial industries are the strongest in terms of printer sales.

Those interested in accessing AMPOWER’s latest report can do so via the company’s website.

AM market analysis

3D printing market analysis can provide some notable insights into how the industry is performing financially, as well as an indication as to the latest trends in additive manufacturing. However, some reports can be limited in their scope, and throw up contradictions as to the true performance of the sector.

For instance, the World Economic Forum recently published a potential roadmap for rapidly driving the wider adoption of 3D printing which stated that despite the “cycles of hype” surrounding 3D printing, “not all predictions and forecasts” about the technology’s potential have become reality.

While AMPOWER’s report has estimated the global metal and polymer additive manufacturing market as growing by 16.2 percent in terms of machine sales between 2020 and 2021, the latest Wohlers Report states the overall additive manufacturing industry grew 19.5 percent in 2021 compared to the prior year.

Similarly, CONTEXT’s most recent industry report observed that while shipments of industrial and “design” printers priced over $20,000 rebounded strongly in 2021, the number of new high-end printers sold during the year still lagged behind pre-Covid levels.

With various studies tapping into different areas of the industry and quantifying and measuring their data against different metrics, it can be difficult to assess the true overall performance of the 3D printing sector.

Subscribe to the 3D Printing Industry newsletter for the latest news in additive manufacturing. You can also stay connected by following us on Twitter and liking us on Facebook.

Looking for a career in additive manufacturing? Visit 3D Printing Jobs for a selection of roles in the industry.

Subscribe to our YouTube channel for the latest 3D printing video shorts, reviews and webinar replays.

Featured image shows global metal and polymer Additive Manufacturing market 2020 to 2021 and supplier forecast 2026. Image via AMPOWER.