Register now for our Additive Manufacturing Advantage online event for insights on AM developments in aerospace, space, and defense sectors from industry leaders!

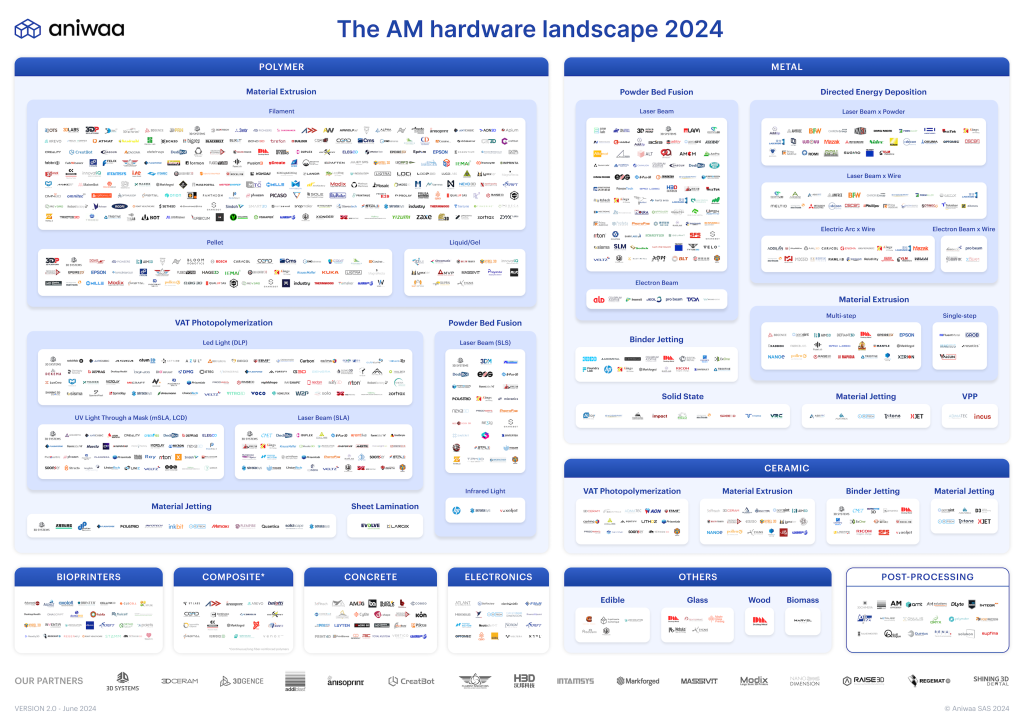

Aniwaa, an online marketplace for AM and 3D capture solutions, has released the second edition of its AM hardware landscape infographic.

As reported by the company, feedback from the AM community has played a key role in enhancing the infographic, leading to over 100 changes. Amid ongoing mergers, the AM sector remains diverse, with many manufacturers offering a wide range of solutions.

To make this complex industry easier to understand, Aniwaa’s infographic covers over 600 manufacturers of AM by materials and technology. This visual guide helps buyers navigate the varied landscape of additive manufacturing. A notable addition is the new section on post-processing, featuring 20 manufacturers focused on areas like powder handling, heat treatment, surface finishing, and coloring.

“Our goal is to provide manufacturers with the tools they need to succeed in this competitive industry,” explained Martin Lansard, Founder of Aniwaa. “Our platform serves as a gateway for manufacturers to showcase their products, reach new markets, and ultimately acquire new customers. We believe that by enabling seamless and valuable interactions between manufacturers and buyers active in the market, we are driving the industry forward.”

Insights on the 2024 AM hardware landscape

Aniwaa’s latest analysis reveals a 3D printing landscape dominated by polymer 3D printing systems, offered by 55% of manufacturers, while metal AM systems hold a smaller share of 26%. Within the metal AM segment which encompasses 157 manufacturers across 29 countries, Direct Energy Deposition (DED) technology is surging by 37%, displacing Laser Powder Bed Fusion systems (LPBF) from its previous top spot which is down to 40% from 50% last year.

Looking geographically, China has 25 manufacturers, followed by Germany with 28 OEMs, and the US leading the pack with 33 manufacturers. One example of US-made AM technology includes that of US-based Additec announcing its Hybrid 3 metal 3D printer at Formnext 2023. This printer combines liquid metal jetting (LMJ), laser directed energy deposition (LDED), and CNC machining.

Designed for automotive metal parts production, it offers 0.5 mm LMJ resolution, 4 kg/hr LDED deposition, and multi-material printing with iron, nickel, aluminum, and copper alloys. Developed in eleven weeks, the Hybrid 3 utilizes COTS welding wire for 100% material utilization. It features a 6kW fiber laser for LDED and CNC capabilities.

“At Aniwaa, we understand the challenges faced by buyers in navigating the complex additive manufacturing ecosystem,” added Lansard. “Our landscape infographic, combined with our digital catalogs, provides buyers with a comprehensive view of all active manufacturers and solutions in each market segment. These insights are invaluable in their journey to make informed purchasing decisions.”

On another note, Aniwaa has achieved a significant milestone with over 160 manufacturers actively managing their profiles on the platform. This growth is fueled by self-service accounts that enable manufacturers to control their presence and connect with potential buyers.

Tracking the evolving landscape of AM hardware

Back in 2018, 3D Printing Industry interviewed Lansard who highlighted the company’s strategy shift, focusing on expanding coverage, increasing product reviews, and enhancing user-friendly comparison tools.

Since 2012, Aniwaa has witnessed the evolution of a professional 3D printer segment and the growing demand for high-performance materials like PEEK and PEI. Lansard emphasized Aniwaa’s commitment to providing comprehensive, accurate information amid the dynamic 3D printing and emerging technology landscapes, ensuring the platform remains a trusted resource for navigating industry trends and innovations.

Building on its vision, Aniwaa offered insights into the AM hardware landscape with its first infographic edition last year, by analyzing over 500 active manufacturers and categorizing them by the materials and technologies they employ. Once again, polymer 3D printers emerged as the most prevalent technology, representing 57% of manufacturers.

Metal AM followed closely at 27%, whereas the remaining 16% included a diverse range of AM techniques, including ceramics, composites, and bioprinting. Notably, the data indicated a growing trend in powder bed fusion (PBF) technology adoption, with 35% of manufacturers offering it compared to 25% the previous year. Fused Deposition Modeling (FDM) remained another widely used technology, present in the offerings of 28% of manufacturers.

Join the Expert Committee for the 2024 3D Printing Industry Awards to help select the winners!

What 3D printing trends do the industry leaders anticipate this year?

What does the Future of 3D printing hold for the next 10 years?

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter, or like our page on Facebook.

While you’re here, why not subscribe to our Youtube channel? Featuring discussion, debriefs, video shorts, and webinar replays.

Featured image shows the AM hardware landscape 2024. Image via Aniwaa.